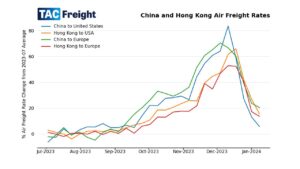

Data released by TAC Index on Monday 15th January showed that air cargo prices from North Asia to Europe had increased, but we have yet to see a ‘surge’ in rates from the current ocean freight disruptions. Higher air freight rates from North Asia to Europe compared to the US, relative to pre-peak levels (average rate in July 2023), supported by the underlying price distribution dynamics, suggest higher and increasing air cargo demand, especially out of China. This is likely in reaction to the ocean freight disruptions combined with the upcoming Lunar New Year holidays when demand and rates tend to rise. The aggregate data does mask some more granular variations as rates on some lanes showed larger increases. For example, Shanghai and Hong Kong to Amsterdam, increased by +9.7% and +6.2% respectively in the week to 15th January. China to Europe and the United States Air freight rates out of China to both Europe and the US saw a slight increase in the week to 15th January. Average air cargo prices from China to Europe increased by +1.3% week on week (WoW), and prices from China to the United States halted their decline with a +0.8% WoW increase. There are significant differences in the current prices compared to their pre-peak average for the two markets (see chart above). From China to Europe air freight rates were 21.6% above their pre-peak average compared to only 6.4% to the US. This suggests that relative demand, in respect to pre-peak levels, is higher to Europe than to the US. Although average rates for both China-Europe and China-US increased slightly last week there were differences in the underlying dynamics of the price distribution observable in the inter-quintile (20th to 80th percentile) ranges (see charts above). From China-US the upper-quintile was stable, but the lower quintile was still declining. Whereas from China-Europe the lower-quintile was stable and the upper-quintile increasing. These price dynamics suggest that air cargo demand to Europe is increasing. Hong Kong to Europe and the United States In the week to the 15th of January air freight rates out of Hong Kong to Europe stabilised with a -0.2% WoW decrease, whereas from Hong Kong to the United States rates continued to decline with -4.6% WoW decrease. In contrast to China, there are no significant differences in the current prices compared to their pre-peak average for the two markets (see chart above). Average prices to Europe indicate the market has stabilised 13% above pre-peak levels whereas to the US they were now only 10% above and still decreasing. Comparing the air cargo price time series for the two markets (plotted above), there were differences in the underlying dynamics of the price distributions. From Hong Kong-Europe, across the full range, prices have been stable WoW. This is in contrast to Hong Kong-US where they have all been decreasing. You can keep up to date with all air cargo price developments at TAC Index.